1

Derivatives Rollover Report | April 01, 2022

For Private Circulation Only

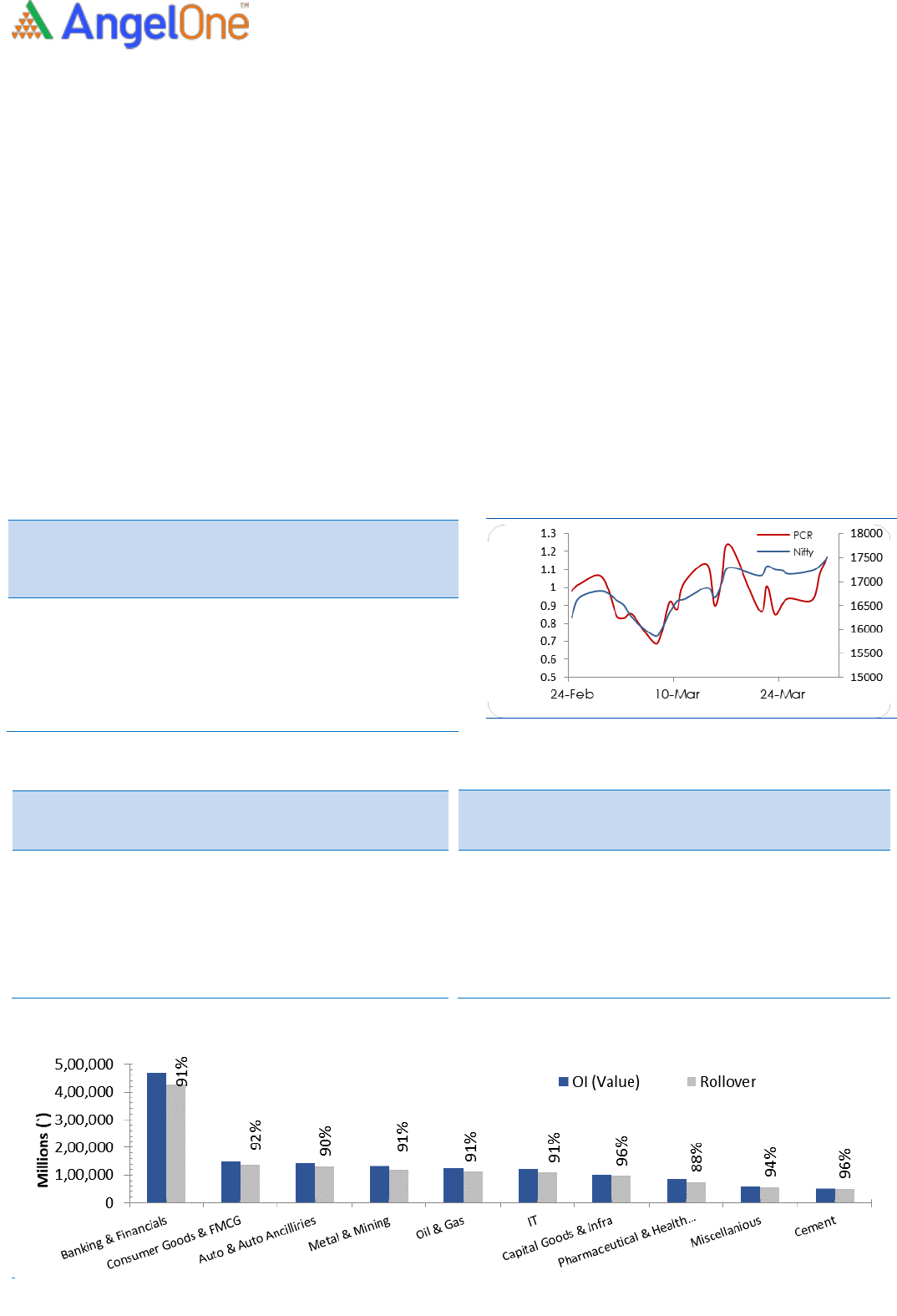

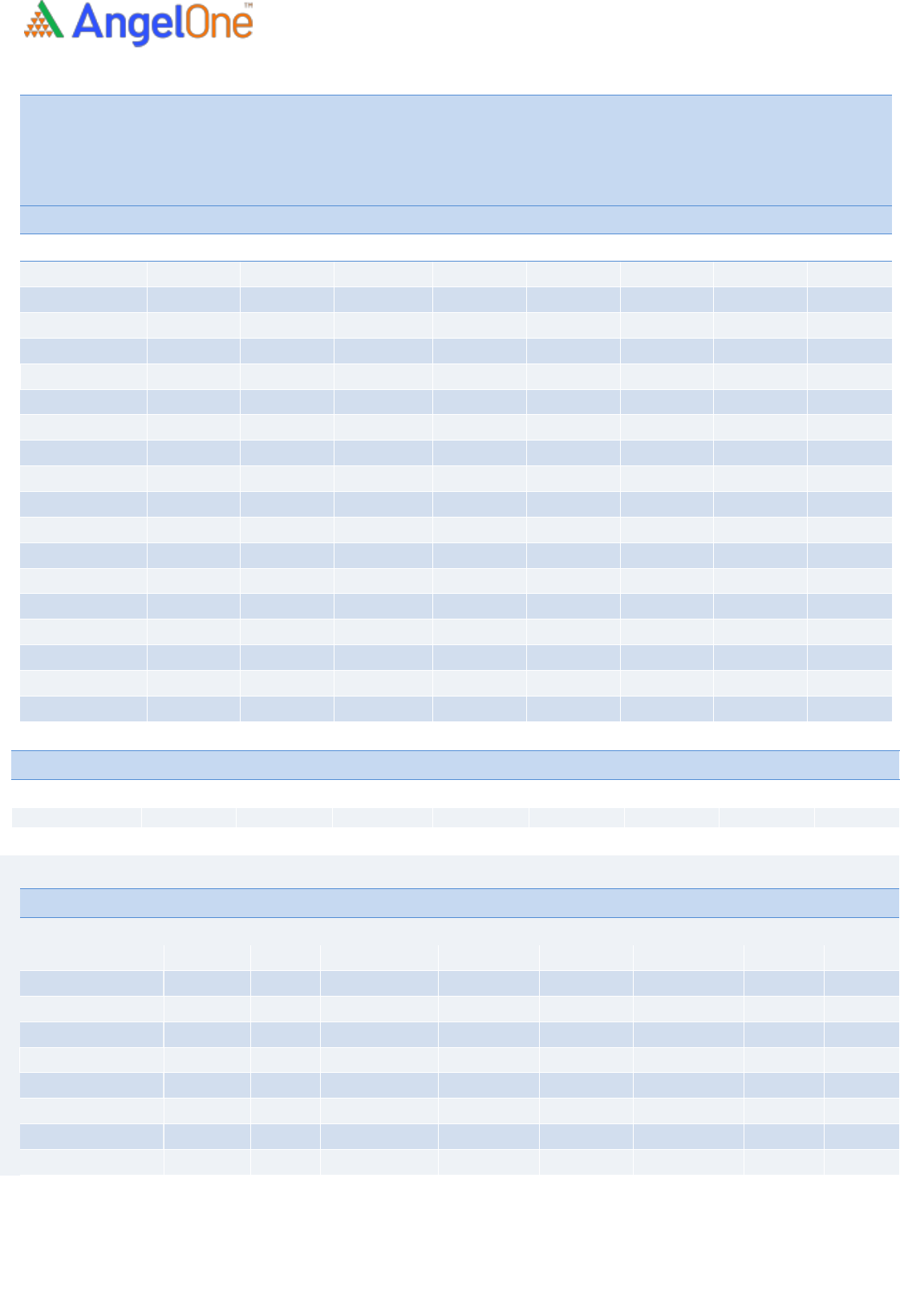

NIFTY & PCR Graph

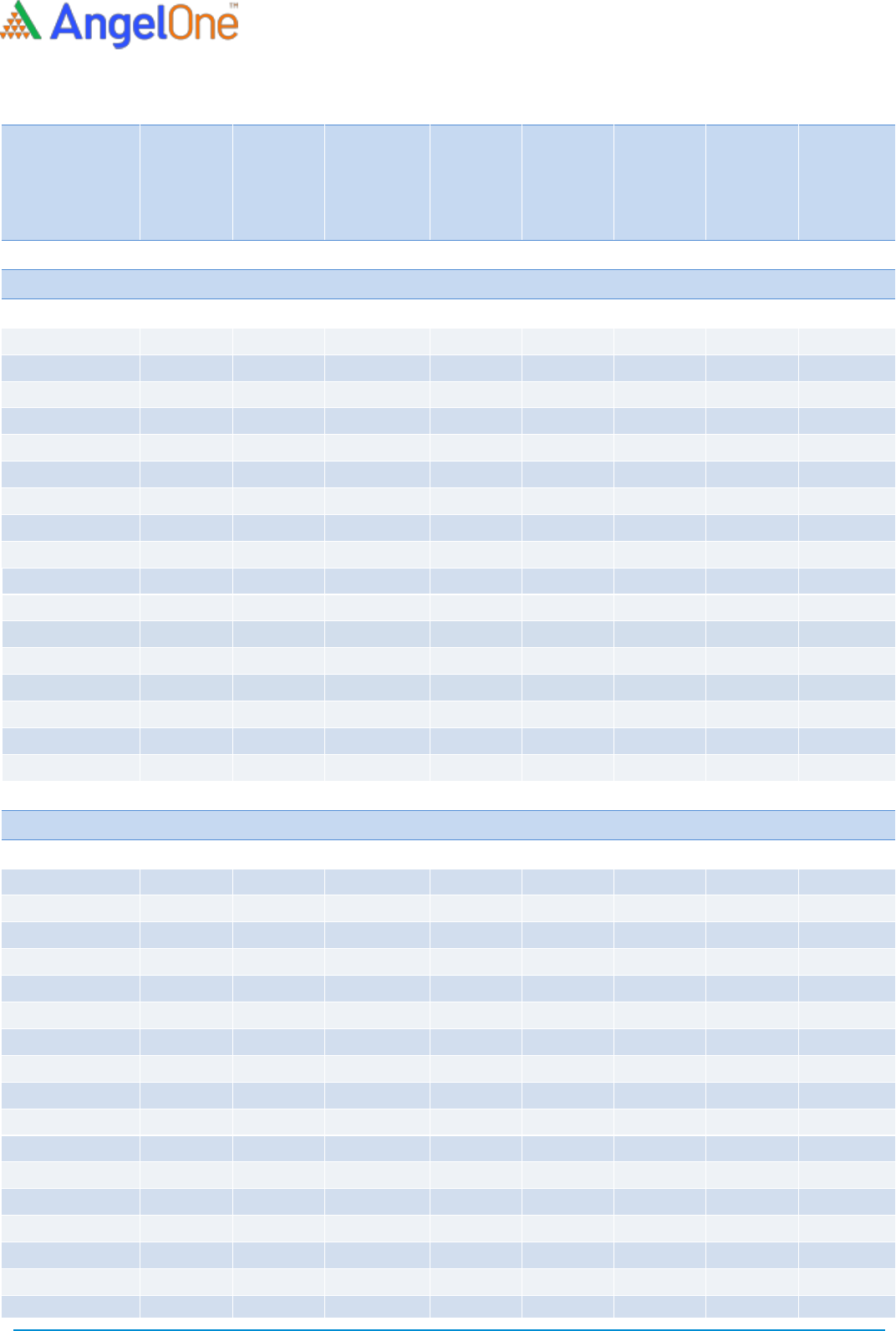

Monthly Gainers

Scrip

Price

Price

Change

(%)

Open

Interest

Ol

Change

(%)

GNFC

842.85

65.35

2501200

(11.74)

INTELLECT

947.30

52.42

1075500

175.77

JINDALSTEL

534.60

44.31

35252500

21.68

DELTACORP

332.35

35.63

14039200

(4.18)

ZEEL

289.20

30.51

62760000

(11.99)

Note: Stocks which have more than 1000 contract in Futures OI.

Monthly Losers

Scrip

Price

Price

Change

(%)

Open

Interest

Ol

Change

(%)

ESCORTS

1510.90

(15.25)

5458750

18.78

GUJGASLTD

505.25

(11.68)

3833750

67.32

JKCEMENT

2444.20

(11.11)

467950

95.47

BIOCON

337.70

(10.05)

15007500

24.43

JUBLFOOD

2652.70

(8.05)

2500375

5.18

Note: Stocks which have more than 1000 contract in Futures OI.

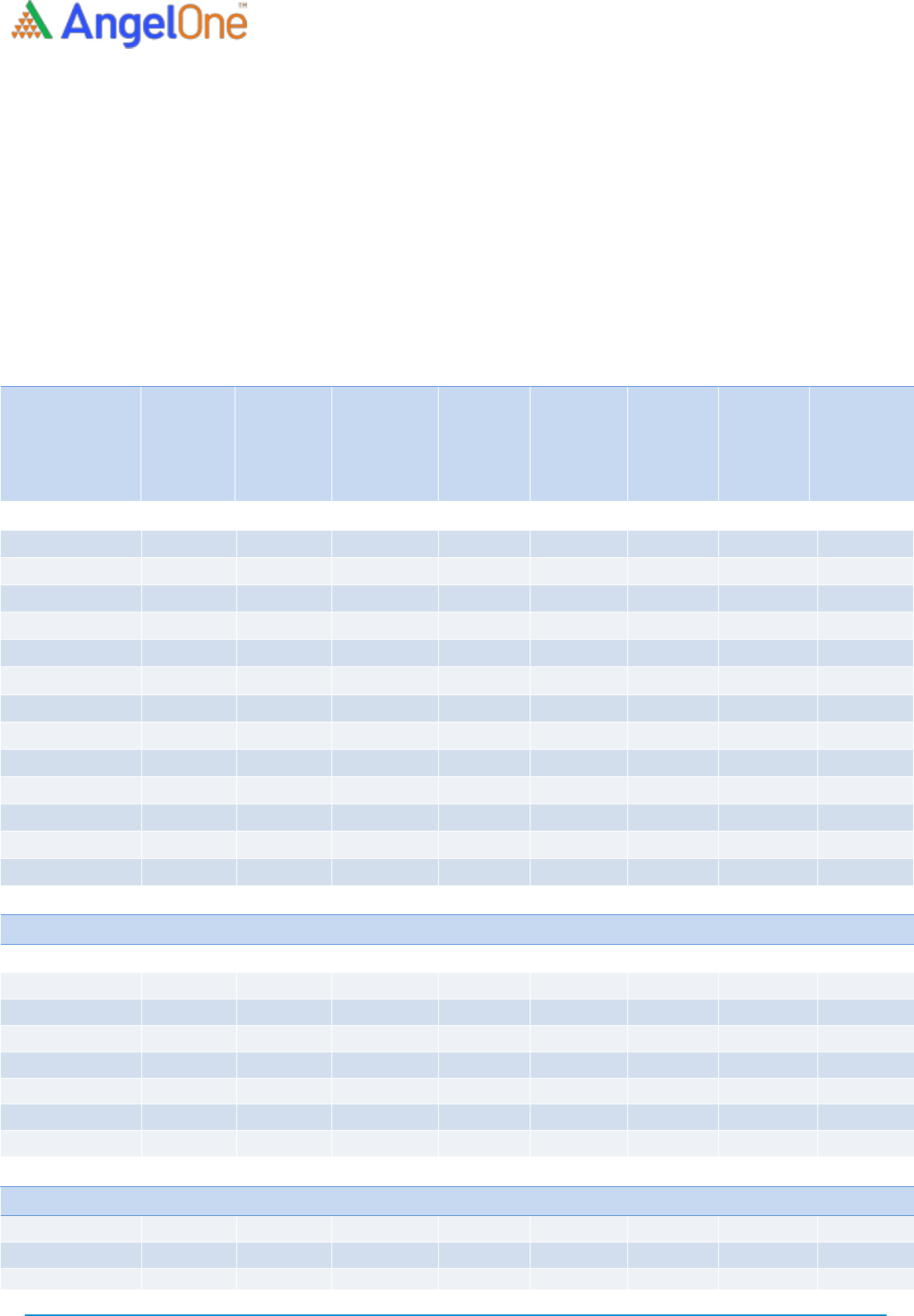

Our Indian equity market finally experienced a strong come back in the concluding series of FY22 after last four series of

negative close. During the initial couple of days, we observed some pain which led to correction towards 15700, which was

then followed by a sharp recovery during the remaining part of the series to reclaim 17500 with some authority.

Now let’s take a quick glance at the F&O activities. During the series, shorts were missing when market was moving

southwards but decent long formation was observed in the market recovery. In case of banking index, we saw meaningful

open interest addition during the series, and it seems majority of them were on the long side. Rollover for Nifty and

BankNifty stood at 82% and 91%, respectively, which is way beyond the three-month average figures. This clearly suggest

longs in the system have been rolled over to the April series. Stronger hands too supported in the recovery by turning net

buyers in equities after six long months. This has certainly poured liquidity in our market and has also bolstered the overall

sentiments. In index futures segment, they exited bearish bets and rolled over longs resulting ‘Long Short Ratio’ surging

from 48% to 62% MoM. The above development hints, market may remain upbeat going ahead and hence, traders are

advised to use declines to pick quality stocks.

Indices Change

INDEX

Price

Price

Change

(%)

Rollover

3 month

avg.

NIFTY

17464.75

7.82

82.12

79.42

BANKNIFTY

36373.60

3.72

91.46

84.16

FINNIFTY

17147.15

4.79

-

-

-

-

-

-

-

-

-

-

-

-

Derivatives Rollover Report

For Private Circulation Only

2

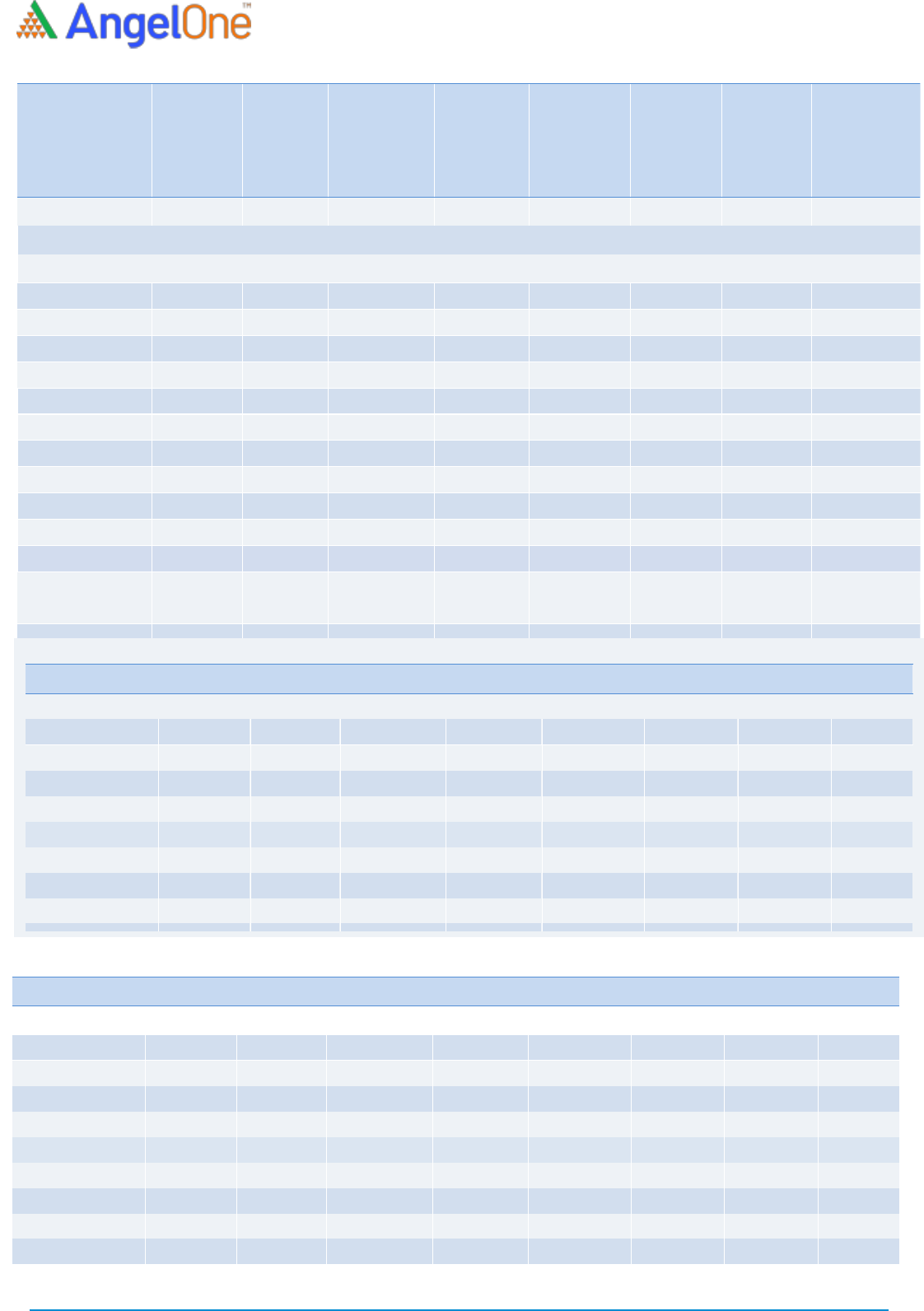

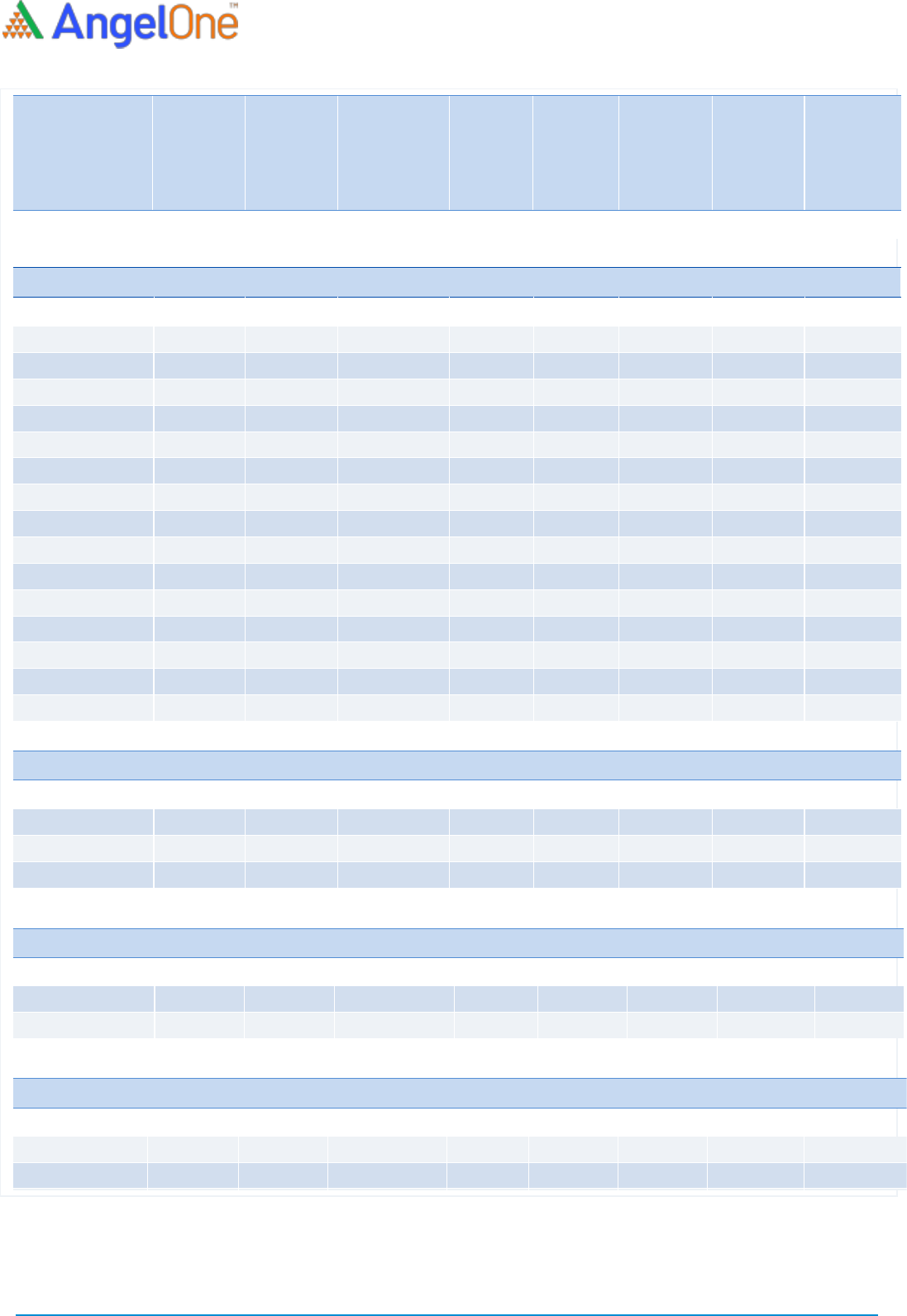

Scrip

Price

Price

Change

(%)

OI

Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

AUTO & AUTO ANCILLARIES

AMARAJABAT

539.70

2.79

7739000

(1.54)

8.02

0.73

96.48

94.11

APOLLOTYRE

192.00

7.23

12607500

14.43

6.82

0.67

89.49

92.12

ASHOKLEY

117.90

3.51

42502500

24.18

7.23

0.52

92.98

92.35

BAJAJ-AUTO

3667.45

5.49

1632000

(18.93)

5.16

0.35

82.08

91.61

BALKRISIND

2144.10

21.56

1235400

(15.01)

4.82

0.31

93.82

95.53

BHARATFORG

705.40

6.59

4947000

(9.41)

8.93

0.17

90.57

95.00

BOSCHLTD

14466.90

(2.63)

150250

25.00

2.55

0.60

94.68

95.89

EICHERMOT

2466.05

(5.74)

3823400

36.65

4.70

0.41

95.10

96.33

ESCORTS

1510.90

(15.25)

5458750

18.78

-138.73

0.24

96.31

78.25

EXIDEIND

151.95

7.54

21168000

(12.19)

7.33

0.73

96.92

93.72

HEROMOTOCO

2308.25

(7.39)

3820500

19.33

7.98

0.70

91.25

93.74

M&M

809.80

1.57

12634300

(10.29)

5.25

0.30

72.91

85.70

MARUTI

7598.65

(7.61)

2203900

(11.02)

6.44

0.42

90.12

92.24

MOTHERSUMI

140.10

(3.18)

26033000

16.89

6.08

0.35

87.06

92.24

MRF

64519.85

2.35

96220

47.01

-9.99

0.35

99.09

98.41

TATAMOTORS

436.20

2.02

74185500

4.14

7.36

0.54

92.28

92.69

TVSMOTOR

628.70

1.75

7228200

1.37

6.35

0.25

89.28

89.80

BANKING & FINANCIALS

AUBANK

1253.70

7.55

2153000

(13.17)

7.79

0.43

94.41

95.03

AXISBANK

763.20

4.22

47064000

22.62

3.51

0.45

93.24

94.21

BAJAJFINSV

17150.50

12.26

561600

(11.87)

6.89

0.43

90.13

92.16

BAJFINANCE

7304.75

10.11

3820625

(7.34)

8.04

0.64

93.86

95.39

BANDHANBNK

309.45

6.19

30717000

42.77

8.69

0.37

93.90

93.45

BANKBARODA

112.30

11.35

113829300

14.99

8.18

0.49

94.28

94.30

CANBK

229.10

9.85

42390000

2.12

7.73

0.74

92.90

94.43

CHOLAFIN

723.05

11.48

7657500

(8.54)

8.35

0.40

90.46

94.63

CUB

129.55

5.63

12875800

17.32

6.57

0.44

95.75

95.46

FEDERALBNK

97.90

4.59

58940000

(3.49)

6.69

0.57

93.97

93.73

HDFC

2402.90

2.32

21381300

(4.72)

6.82

0.64

87.55

93.65

HDFCAMC

2153.95

6.77

2899400

1.81

4.80

0.50

96.74

97.28

HDFCBANK

1475.70

3.73

40180800

50.49

4.74

0.66

84.20

91.87

IBULHSGFIN

158.90

6.82

35615900

26.20

9.09

0.56

92.95

81.51

ICICIBANK

731.60

3.32

110188375

12.68

2.32

0.59

90.08

92.40

ICICIPRULI

503.05

7.50

6346500

(13.59)

5.73

0.28

83.53

91.74

IDFCFIRSTB

39.95

3.23

232545000

59.86

8.21

0.73

92.77

94.04

INDUSINDBK

939.70

7.19

24655500

(0.81)

5.99

0.64

94.61

95.75

KOTAKBANK

1762.15

(1.40)

17058800

30.39

6.13

0.55

95.06

95.07

Derivatives Rollover Report

For Private Circulation Only

3

AARTIIND

959.05

10.99

1825800

(14.56)

91.57

COROMANDEL

802.50

9.50

1185625

32.38

132.38

DEEPAKNTR

2258.45

21.72

1760250

(9.03)

239.13

NAVINFLUOR

4102.25

12.32

388125

(2.49)

179.27

PIDILITIND

2465.30

6.83

2585000

(12.27)

163.59

PIIND

2831.70

18.21

1592500

(14.71)

155.99

TATACHEM

980.10

24.90

5131000

(13.46)

215.40

UPL

774.45

22.41

23097100

(19.81)

7.93

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

L&TFH

80.25

28.81

48698268

(25.84)

-5.66

0.46

91.42

93.80

LICHSGFIN

361.35

9.17

21112000

3.00

8.53

0.62

96.21

94.17

M&MFIN

160.10

14.44

34600000

13.38

7.78

0.67

95.17

94.16

MANAPPURAM

114.05

3.78

28767000

12.60

5.74

0.71

95.11

93.45

MFSL

755.70

(5.92)

1995500

40.63

3.11

0.16

85.83

93.72

MUTHOOTFIN

1325.30

1.66

3287625

20.67

-5.53

0.64

81.77

84.73

NAM-INDIA

350.15

17.15

2801600

15.81

9.37

0.09

93.49

95.27

PFC

113.20

7.35

38427600

(7.34)

6.95

0.58

95.12

91.19

PNB

35.25

9.30

236704000

98.55

7.44

0.73

95.27

83.72

RBLBANK

131.05

6.76

44010400

15.21

8.51

0.61

95.03

90.07

RECLTD

123.90

5.90

29100000

(4.30)

9.00

0.82

94.51

90.19

SBIN

496.10

5.15

69348000

(3.06)

6.74

0.56

90.84

91.93

SRTRANSFIN

1140.75

6.97

4048800

13.27

6.78

0.23

95.63

94.31

CAPITAL GOODS & INFRASTRUCTURE

ADANIPORTS

777.85

18.43

83248750

(3.63)

6.15

0.41

98.26

98.34

BHEL

49.75

12.18

101178000

(4.29)

10.57

0.65

96.65

96.12

GMRINFRA

37.10

7.23

116775000

37.56

5.29

0.64

93.82

93.76

HAVELLS

1160.20

1.03

4150000

6.15

8.60

0.35

90.00

92.38

LT

1774.95

0.87

12376300

(2.53)

5.38

0.61

91.10

89.81

SIEMENS

2374.55

3.65

1562550

14.86

3.50

0.30

98.58

93.93

VOLTAS

1251.05

6.72

2922500

(20.78)

5.91

0.31

94.73

95.15

CEMENT

ACC

2108.20

4.38

2501000

15.03

-26.15

0.33

91.28

94.50

AMBUJACEM

300.85

(0.08)

26511000

36.72

6.97

0.44

94.60

95.22

GRASIM

1672.85

7.97

10028200

0.64

6.93

0.39

97.32

97.42

RAMCOCEM

768.90

0.42

3048100

120.27

1.44

0.29

98.25

97.18

SHREECEM

24124.50

4.50

197850

8.29

4.99

0.39

96.27

97.95

ULTRACEMCO

6622.80

2.92

2155400

9.96

4.05

0.52

95.07

95.85

Derivatives Rollover Report

For Private Circulation Only

4

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

Consumer Goods & FMCG

ASIANPAINT

3097.45

0.79

5321400

22.26

7.41

0.62

97.00

95.90

BERGEPAINT

701.90

3.23

4051300

(8.20)

4.10

0.30

96.36

96.90

BERGEPAINT

BRITANNIA

3200.90

(7.07)

1479000

3.24

-2.22

0.47

91.26

94.27

BRITANNIA

COLPAL

1544.80

11.75

2272900

17.73

2.16

0.25

91.72

90.93

COLPAL

DABUR

538.90

0.88

11658750

(12.91)

6.56

0.27

92.15

95.73

DABUR

GODREJCP

749.35

(3.05)

8409000

41.22

3.58

0.32

97.20

96.56

GODREJCP

HINDUNILVR

2055.05

(5.62)

14185500

43.04

4.07

0.51

95.80

96.02

HINDUNILVR

ITC

252.10

21.09

113273600

(33.71)

7.54

0.62

81.88

89.90

ITC

JUBLFOOD

2652.70

(8.05)

2500375

5.18

8.03

0.59

91.90

93.13

JUBLFOOD

MARICO

505.10

4.18

7905000

(9.37)

3.62

0.35

85.54

90.59

MARICO

MCDOWELL-N

890.55

5.55

13142500

(12.05)

3.23

0.54

91.85

95.95

MCDOWELL-N

NESTLEIND

17356.80

(2.28)

290925

(9.38)

-1.78

0.69

85.61

92.75

NESTLEIN

D

TATACONSUM

782.10

15.03

9333225

(16.98)

7.88

0.28

97.11

96.66

TATACON

SUM

TITAN

2549.60

5.83

5779875

0.36

6.91

0.45

95.79

95.28

TITAN

UBL

1495.70

2.90

1265600

52.57

5.38

0.27

86.63

79.56

UBL

ASIANPAINT

3097.45

0.79

0.62

97.00

95.90

COALINDIA

293.80

1.71

14714400

2

9

.

8

0

8.26

0.35

63.04

65.79

HINDALCO

88.10

30.23

34330000

(

1

3

.

3

6

)

2.22

0.61

78.46

82.59

HINDZINC

182.40

10.61

3964800

1

0

8

.

5

9

-8.52

0.34

71.17

74.01

(

METALS & MINING

COALINDIA

184.15

23.05

35095200

(0.71)

7.83

0.49

88.29

86.71

HINDALCO

573.30

10.74

27817775

(19.15)

8.70

0.32

78.84

82.30

JINDALSTEL

534.60

44.31

35252500

21.68

4.28

0.66

96.50

97.00

JSWSTEEL

737.10

29.00

26041500

(31.96)

7.92

0.55

91.55

95.99

NATIONALUM

122.30

9.20

86921000

(2.85)

5.35

0.50

96.41

96.50

NMDC

163.55

21.60

67107200

(8.87)

8.02

0.59

92.44

89.36

SAIL

99.20

16.91

142623500

(5.32)

8.60

0.63

95.18

95.02

TATASTEEL

1315.05

22.24

31987625

(24.66)

7.83

0.55

93.56

96.35

VEDL

405.75

22.69

56106900

3.71

7.76

0.49

89.20

81.63

TEXTILES

INFORMATION TECHNOLOGY

COFORGE

4473.15

6.88

1037100

110.32

4.62

0.51

78.80

77.20

HCLTECH

1165.10

5.76

19065900

(4.75)

1.51

0.51

90.35

89.53

INFY

1913.70

13.92

26398500

(33.65)

4.68

0.63

89.59

92.22

LTI

6193.10

10.44

1169250

22.81

7.97

0.49

95.79

88.67

MINDTREE

4326.05

20.91

2221800

(19.02)

7.01

0.48

94.13

96.19

MPHASIS

3395.00

14.87

1318450

(15.15)

7.01

0.33

91.40

94.95

NAUKRI

4536.50

5.94

1683000

1.29

7.80

0.46

97.47

94.42

TCS

3753.30

10.01

10233000

(23.68)

4.65

0.55

94.95

93.03

TECHM

1504.40

12.79

12440400

(21.93)

4.30

0.56

96.63

93.55

WIPRO

590.35

10.22

28249600

(20.54)

-3.41

0.54

93.18

92.05

TELECOM

BHARTIARTL

350.55

0.39

34602594

(4.18)

7.10

0.90

89.38

87.82

IDEA

12.45

(7.43)

363300000

(10.52)

10.56

0.83

82.76

85.28

INFRATEL

276.95

1.58

6836000

3.14

10.20

0.49

84.58

83.89

TEXTILES

ARVIND

66.40

(15.36)

5862000

(11.53)

5.92

1.09

82.52

89.16

CENTURYTEX

959.75

(7.62)

3744000

5.98

-1.70

0.81

98.89

99.06

PAGEIND

20491.75

6.10

156325

9.82

-9.51

0

96.19

89.39

RAYMOND

739.95

(13.35)

2732800

4.75

7.00

1.38

97.21

96.63

Derivatives Rollover Report

For Private Circulation Only

5

Scrip

Price

Price

Change

(%)

OI

Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month

)

(%)

INFORMATION TECHNOLOGY

HCLTECH

564.00

(0.70)

22885800

(1.26)

8.14

0.58

98.56

96.78

INFY

730.55

3.77

24351600

(52.50)

2.86

0.74

55.98

79.52

MINDTREE

782.95

10.93

1041600

(14.29)

-15.63

0.59

93.13

93.37

NIITTECH

1606.65

6.68

578250

26.08

-2.03

0.46

89.76

82.99

TCS

2212.80

6.19

15671500

(17.22)

6.42

1.91

95.02

94.74

TECHM

775.75

1.00

15406800

8.21

9.05

0.65

96.29

97.15

WIPRO

249.90

3.65

18211200

(29.64)

-2.08

0.72

83.12

92.60

MISCELLANIOUS

ABFRL

302.70

20.72

10407800

(19.10)

2.59

0.12

96.78

95.53

ADANIENT

2020.70

30.26

19292500

(9.18)

3.85

0.68

95.92

97.56

APOLLOHOSP

4542.50

3.57

2114875

(17.68)

7.62

0.39

94.58

96.02

ASTRAL

2017.85

13.05

666050

(38.92)

-3.29

0.73

96.65

96.27

BATAINDIA

1974.00

10.95

1407450

10.21

8.37

0.26

91.98

90.15

BEL

212.15

12.94

30901600

27.20

8.35

0.60

95.14

92.48

CONCOR

675.55

20.73

5989600

9.54

6.59

0.34

93.08

94.32

CUMMINSIND

1118.50

20.51

1783200

9.10

-3.31

0.45

84.58

87.49

HDFCLIFE

540.10

1.35

31930800

24.50

4.60

0.50

96.67

94.90

ICICIGI

1334.25

7.71

2989450

6.61

5.84

0.27

94.66

96.38

INDHOTEL

239.95

23.62

20295012

25.77

7.93

0.52

82.46

88.80

INDIGO

2025.30

10.67

2517500

(21.27)

7.25

0.51

84.27

91.83

IRCTC

775.20

5.09

11376750

18.57

0.84

0.54

95.62

93.70

LALPATHLAB

2566.15

2.99

822375

(0.11)

-22.12

0.21

94.91

94.61

LTTS

5116.75

20.39

562600

(11.57)

2.94

0.39

95.81

95.90

METROPOLIS

2040.15

2.52

554600

(11.35)

2.82

0.35

79.89

83.69

SBILIFE

1125.20

6.60

7310250

(6.22)

4.36

0.38

91.33

92.66

TRENT

1281.65

25.49

2039425

(15.78)

6.29

0.18

79.06

84.19

MEDIA

PVR

1926.75

26.84

2654861

16.38

3.05

0.42

91.22

92.84

SUNTV

492.50

14.92

12738000

5.31

7.05

1.00

93.54

95.33

ZEEL

289.20

30.51

62760000

(11.99)

3.84

0.62

94.92

95.63

IGL

506.15

(1.77)

5178250

(23.81)

7.68

1.13

97.21

91.91

IOC

91.70

(9.79)

62803000

(12.25)

9.18

0.66

93.34

91.89

MGL

1142.20

(4.95)

1020000

(34.79)

1.01

0.96

95.18

90.39

ONGC

102.90

(13.13)

38269000

(13.29)

9.20

0.69

92.19

84.88

PETRONET

222.20

(14.51)

18006000

4.88

6.85

0.92

96.78

95.76

RELIANCE

2008.90

(6.90)

26297500

(1.73)

9.11

0.63

97.62

95.78

BPCL

470.70

11.69

44681400

8.98

8.89

0.51

93.84

91.32

BATAINDIA

1444.10

8.68

1488850

(10.54)

-2.88

0.42

93.06

94.61

BEL

115.85

1.49

22602000

(2.49)

10.21

0.44

97.34

96.42

MCX

659.60

(6.88)

2102100

(7.23)

11.16

0.79

93.26

90.88

MCX

1111.60

2.65

1348000

12.33

-3.27

0.66

92.87

80.54

OIL & GAS

BPCL

361.70

9.13

21285000

(2.48)

8.52

0.67

83.37

87.76

GAIL

155.90

21.94

31232000

4.88

2.09

0.35

89.94

87.00

GUJGASLTD

505.25

(11.68)

3833750

67.32

5.31

0.49

95.22

94.85

HINDPETRO

270.65

0.33

14407200

68.27

6.29

0.64

89.67

83.63

IGL

374.35

12.50

15145625

(16.39)

4.19

0.60

96.22

94.97

IOC

119.70

10.12

51103000

57.59

8.22

0.52

91.94

85.14

MGL

783.40

14.96

3220200

(14.44)

7.19

0.35

95.65

95.19

ONGC

164.85

5.34

65365300

107.56

7.56

0.52

82.67

86.61

PETRONET

194.40

1.51

20859000

16.43

4.37

0.51

90.55

94.73

RELIANCE

2650.45

17.19

30970750

(0.56)

7.77

0.52

93.49

94.92

AUROPHARMA

1037.15

6.60

8765250

(5.00)

7.85

0.51

97.81

95.86

BIOCON

383.45

(3.23)

17434000

0.03

5.93

0.71

86.18

89.52

CADILAHC

629.55

11.44

22301400

43.30

6.29

0.51

95.72

93.45

CIPLA

946.80

3.82

10505950

(19.23)

6.89

0.53

91.10

89.74

Derivatives Rollover Report

For Private Circulation Only

6

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC

(%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

PHARMACEUTICAL

ALKEM

3565.75

12.13

142600

(50.45)

-19.75

0.31

88.79

86.80

APLLTD

745.95

6.03

1768900

7.95

7.65

0.79

98.40

93.45

AUROPHARMA

672.60

10.90

14684250

5.64

7.90

0.52

95.55

95.48

BIOCON

337.70

(10.05)

15007500

24.43

8.35

0.61

87.12

93.01

CIPLA

1024.95

14.39

7750600

(19.71)

8.84

0.38

82.47

85.19

DIVISLAB

4429.70

12.21

2195000

(13.63)

8.19

0.45

96.43

96.65

DRREDDY

4316.70

5.60

2637875

(3.13)

6.43

0.62

93.26

90.40

GLENMARK

444.70

3.23

6962100

(3.41)

7.96

0.53

92.23

95.29

GRANULES

308.30

14.95

11414200

(0.27)

7.66

0.37

97.46

95.41

LUPIN

749.55

5.10

10300300

15.03

4.36

0.61

93.98

91.79

PEL

2195.70

12.60

3801050

(10.58)

5.25

0.70

93.61

95.46

PFIZER

4376.15

3.76

123625

(0.20)

8.33

0.73

96.02

94.35

STAR

349.15

11.09

4909500

20.00

9.59

0.63

96.12

95.12

SUNPHARMA

916.55

11.67

17196900

(21.47)

2.57

0.38

73.94

86.32

TORNTPHARM

2799.85

4.67

684750

(12.99)

3.64

0.67

92.78

92.85

POWER

NTPC

135.90

9.46

52155000

44.60

8.69

0.45

74.79

78.13

POWERGRID

217.80

13.94

29870133

15.32

6.01

0.99

87.27

87.51

TATAPOWER

240.05

17.50

97956000

(11.56)

7.65

0.60

93.18

94.52

REAL ESTATE

DLF

382.85

19.44

34790250

(15.09)

8.22

0.65

96.96

95.86

GODREJPROP

1677.85

15.48

4188925

(18.98)

4.40

0.53

92.45

94.83

TELECOM

BHARTIARTL

757.30

12.73

52258550

(9.48)

4.06

0.48

88.52

93.20

IDEA

9.80

0.51

486990000

(29.07)

20.26

0.58

67.19

74.81

INDUSTOWER

223.45

12.97

15464400

(25.82)

8.22

0.45

56.14

80.43

TEXTILES

PAGEIND

40152.00

(1.65)

89610

13.53

-1.14

0.15

88.90

87.89

Derivatives Rollover Report

For Private Circulation Only

7

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chav[email protected]

Sneha Seth Derivatives Analyst

sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited, Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository

Participant with CDSL and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a

Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research

Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/

suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this

document should make such investigations as they deem necessary to arrive at an independent evaluation of an

investment in the securities of the companies referred to in this document (including the merits and risks involved), and

should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the

securities of the subject company at the end of the month immediately preceding the date of publication of the research

report. Neither Angel or its associates nor Research Analysts or his relative has any material conflict of interest at the time

of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the

period preceding twelve months from the date of this report for services in respect of managing or co-managing public

offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a

merger or specific transaction in the normal course of business. Angel or its associates did not receive any compensation

or other benefits from the companies mentioned in the report or third party in connection with the research report.

Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding

positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a

report on a company's fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports

available on our website to evaluate the contrary view, if any.